When you want to buy EUR and sell USD, you would buy the EUR/USD pair. When you want to buy USD and sell EUR, you would sell the EUR/USD pair. But maybe you have a balanced portfolio in place, and now you’re looking for an adventure with some extra cash. Provided you know what you’re doing — please take those words to heart — forex trading can be lucrative, and it requires a limited initial investment.

Outlook 2023: Foreign exchange traders might actually have to earn … – OMFIF

Outlook 2023: Foreign exchange traders might actually have to earn ….

Posted: Thu, 05 Jan 2023 08:00:00 GMT [source]

Capital.com requires a minimum deposit of just $20 too – which is ideal for newbies. We found the spreads at AvaTrade to be very competitive, with EUR/USD starting at 0.9 pips and USD/JPY at 1.1 pips. Opening an account at AvaTrade should take you no more than a few minutes and you can instantly deposit funds with a debit or credit card.

However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. For example, the height of a triangle at the widest part is added to the breakout point of the triangle (for an upside breakout), providing a price at which to take profits. Just as with your entry point, define exactly how you will exit your trades before you enter them. The exit criteria must be specific enough to be repeatable and testable.

What is a currency pair?

There are enough hours in the day to trade in this potentially profitable market, even if you hold a full-time or part-time job. In this article, we’ve outlined some tips how to make money from forex trading to help get you there. The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate.

- Forex trading, short for foreign exchange trading, is a popular financial market where traders buy and sell different currencies with the aim of making a profit.

- It is easy to be profitable in the short-term, such as when measured in days or weeks.

- Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade.

- You should also manage your trading account by setting a maximum risk per trade and not risking more than you can afford to lose.

- The only difference between Costco and JP Morgan is what they sell, not how they operate or make and lose money.

As you can see from the example above, the eToro Copy Trading tool allows you to actively trade forex without needing to do anything. To help you along the way, below we discuss five strategies that can help you to making money with forex. The way to approach this is to create a bankroll management plan. This will limit the amount of capital you risk on each trade and is best viewed as a percentage of your forex account balance. For example, capping your stakes to 1% would mean that a $1,000 balance would permit a maximum trade value of $10.

Scalping and trading the news require a presence of mind and rapid decision-making that, again, may pose difficulties for a beginner. You’ve defined how you enter trades and where you’ll place a stop-loss order. Now, you can assess whether the potential strategy fits within your risk limit. If the strategy exposes you to too much risk, you need to alter it in some way to reduce the risk. It’s important to define exactly how you’ll limit your trade risk. A stop-loss order is designed to limit losses on a position in a security.

There are numerous exchanges covering different time zones around the world. These exchanges allow us to trade forex, 24 hours a day, from Sunday 6 pm till Friday 5 pm, EST (United States Eastern Standard time). Unfortunately, that’s something all forex traders need to accept. Even if you’d actually prefer to trade stocks or another instrument, forex is a good place to start and help you understand the fundamentals of trading and potentially gain some capital. The best way to learn all of the above is with a forex trading course. Trading Education is currently offering a free forex trading education for beginners.

What Is the Forex Market?

Forex trading can be extremely volatile, and an inexperienced trader can lose substantial sums. For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than in other markets. For those with longer-term horizons and more funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals that drive currency values, as well as experience with technical analysis, may help new forex traders become more profitable. For small traders with mini accounts and beginners who lack experience, trading U.S. currency against various foreign currencies is advised. The great majority of dollar volume traded on forex markets occurs in the currency pairs below.

Part-time traders are advised to take profits when they materialize instead of anticipating wider spreads and bigger profits. This requires a degree of self-discipline in fast trending markets where favorable spreads can widen. Part-time forex trading can be a successful way to supplement your income.

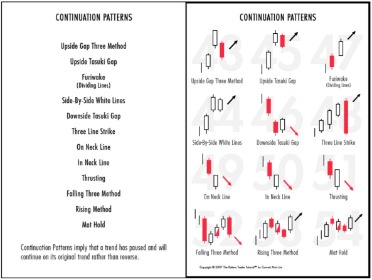

Candlestick Charts

The return that you expect from trading a currency pair is the same as the money market and less than stocks or bonds. However, you can increase the returns and risk by making use of leverage. Ensure your profits are safe by only engaging in currency trading with a reputable online forex broker.

It requires you to add funds to your account at the end of the day if your trade goes against you. Therefore, using stop-loss orders is crucial when day trading on margin. Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. Remember that you’ll have to pay taxes on any short-term gains—investments that you hold for one year or less—at the marginal rate.

Do you need a license to be a forex trader?

Exotic currency pairs involve less-traded currencies from developing countries such as the Mexican peso and the South African rand. The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in Euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position. Forex trading is the exchange (or trading) of currencies on the foreign exchange market. Trading occurs in currency pairs such as the EUR/USD (the euro versus the U.S. dollar) and the USD/CAD (the U.S. dollar versus the Canadian dollar).

- Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release.

- The reason for this is that exotic currencies can be very volatile – which is something you will want to avoid as a newbie.

- Assuming you have set up a stop-loss and take-profit, your forex position will close automatically when one of your stated price points is triggered.

- It’s much more fun to lose play money than real money, especially while you’re learning the ropes.

Market participants are institutions, investment banks, commercial banks, and retail investors from around the world. You’ll often see the terms FX, forex, foreign exchange market, and currency market. The first reason is that returns to passively holding foreign currencies are low, similar to the money market. When U.S. investors buy euros in the forex market, they are really investing in the EU’s money market.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% per month, thanks to leverage. Remember, you don’t need much capital to get started; $500 to $1,000 is usually enough. The potential profits and losses can be substantial due to the leverage offered to traders, which can run as high as 400-to-1.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to https://g-markets.net/ pin point currency direction sometimes. Before starting to trade live, traders use Demo accounts to train their trading skills. According to these strategies, there are different types of traders. Diverse trading styles depend on the time frame and length of the period during which the order is open.

Fundamental Research

The low returns for passive investment in the forex market also make it much harder to confuse a bull market with being a financial genius. If you can make money in the forex market, you can make it anywhere. Another perspective on currency trading comes from considering the position an investor is taking on each currency pair. The base currency can be thought of as a short position because you are “selling” the base currency to purchase the quoted currency.

The benchmark 10-year US Treasury bond yield holds steady above 4.2% following Thursday’s pullback, limiting XAU/USD’s volatility ahead of the weekend. This will depend on several factors, such as where you live and whether you are a retail or professional client. The vast majority of forex EAs are built for MT4, but MT5 is ofter supported too. Either way, you will need to purchase your chosen forex EA and then install it into either MT4 or MT5.