Your business may pay whatever overtime rate it chooses as long as that rate doesn’t fall below the minimum 1.5 times an employee’s regular pay rate (i.e., time-and-a-half) set by law. That said, the overtime rate set by the government is just the minimum businesses have to pay their workforce for any overtime accumulated. A business could set its overtime rate at any number as long as it does not drop below 1.5 times the employee’s regular hourly wage.

Finally, you add this overtime pay to the regular pay to get the employee’s weekly earnings. If the average work week of an employee is 40 hours and he works 50 hours, he could be eligible to earn overtime pay for the extra hours he has worked. According to the Fair Labor Standards Act (FSLA), overtime pay refers to the additional compensation eligible employees receive when working more than their defined number of working hours. Read the FLSA fact sheet[3] to learn more about each of these exemptions and if they apply to you. If you are a salaried employee, make more than $684 per week, and are included in one of these exemptions, then you will most likely not be eligible for overtime pay. To calculate the overtime for an employee that is paid on salary, start by converting their salary to an hourly wage.

According to the FLSA, overtime starts accruing the moment a nonexempt employee works more than 40 hours. It doesn’t matter if an employee works more than eight hours a day as long as they don’t exceed the 40-hour threshold for the entire week. However, some states also require daily overtime pay if an employee works more than eight hours in a 24-hour period.

Increase billable hours

The former requirement was that a salaried employee paid more $455 a week ($23,660 a year) or more was not subject to overtime. The increase means that an exempt employee who is paid $684 a week (the equivalent of $35,568 a year) or more would not be subject to overtime. Three basic tests can help you determine how to categorize your employees. An exempt employee will meet the requirements of all three tests, but you should still consult legal counsel to determine their applicability to your employee’s specific job role and compensation.

Bilflo and Top Echelon Software Partner to Streamline Contractor Management and Enhance Efficiency for – EIN News

Bilflo and Top Echelon Software Partner to Streamline Contractor Management and Enhance Efficiency for.

Posted: Mon, 21 Aug 2023 15:01:04 GMT [source]

The basic overtime formula is (Hourly Rate) × (Overtime Multiplier) × (Number of Overtime Hours worked in a particular week). Almost all states follow FLSA regulations regarding overtime except for those that have their own state overtime law like California and Montana. These states still adopt some provisions from FLSA but they’ve also added their own regulations. An employee works 45 hours during the week and assembles 150 components, earning $300. The most effortless and intuitive time tracking software for teams whi bill their time. Looking for better remote employee time tracking solutions in the new normal of hybrid work?

What are the penalties for failing to pay overtime?

Keep reading to learn helpful information about overtime rules and overtime pay according to labor law regulations. What is more, you will discover what is time, and a half pay, who is an exempt employee is, and some examples of exempt jobs. If you offer an employee a bonus for completing a task that takes longer than their 40-hour workweek, you may owe overtime pay for the time they spent on the task. The DOL website shows how to calculate the amount due to an employee who worked a 43-hour week with a $50 bonus.

HR Hotline: How Do We Calculate Overtime Pay During a Holiday … – CBIA

HR Hotline: How Do We Calculate Overtime Pay During a Holiday ….

Posted: Thu, 22 Jun 2023 07:00:00 GMT [source]

Talk to a lawyer or payroll professional if you’re unsure how to proceed. In this article, we discuss how to calculate overtime so you can keep your spending under control. This shows you are taking initiative, and if your performance is above average, your boss should be willing to give you more work. Keeping track of all of this is impossible to do on paper, but with the right tools in place, you can be sure to stay compliant with federal and state laws. A tipped employee is anyone who generally makes $30 or more a month in tips (though some states have a lower cutoff). If you’re making payroll for a restaurant, this will likely include a big chunk of your staff.

How to Compute FLSA Overtime Pay

Though overtime is limited and it may also be inevitable sometimes, it is a part of the job that can impact your employee’s work-life balance and performance. For employees working regular days from Monday to Friday, Sunday will be considered the rest day. Usually, big companies prefer to outsource their payrolls as it is a smarter option to let the pros manage the regulations and calculations. Moreover, calculating pay can quickly become complicated if you’re unsure what to do.

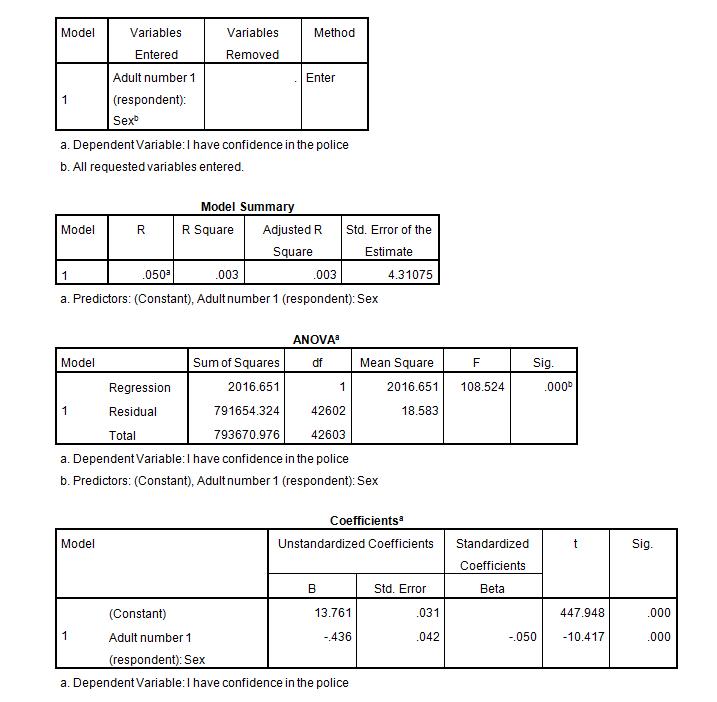

- An employee’s regular pay rate is based on the amount of calculated earnings divided by the number of hours worked.

- The chart below explains what is included in determining the regular wage.

- It’s the end of the year, and Patrice, a barista, has been working at a coffee shop in the lead-up to Christmas.

- Thus, the Regular Rate increases or decreases based on how many hours an employee works in any given week.

- The Fair Labor Standards Act, passed in 1938, guarantees employees compensation at one and a half times their regular rate for hours worked above 40 hours per week.

- The calculation is different here because any overtime hours are already partially compensated for by the weekly salary.

There is no limitation in the FLSA on the number of hours employees over the age of 15 may work in any workweek. The FLSA does not require overtime pay for hours in excess of eight hours worked in a day, except as discussed below, or for hours worked on Saturdays, Sundays, or holidays. Under the Employment Act, employees are entitled to at least one rest day a week. If an employee has more than one rest day, the last day will be considered the rest day to calculate overtime pay. From overtime and bonuses to paying and filing taxes, payroll can be a hassle.

How to Calculate Overtime for a Salaried Employee

This includes a base rate and any additional compensation such as commission or non-discretionary bonuses. The chart below explains what is included in determining the regular wage. When you’re calculating time-and-a-half overtime pay for employees with flexible schedules, the unit of time you want to look at is the seven-day workweek.

- Investigators recommend changes to ensure such violations don’t happen again.

- Overtime gets confusing when it comes to salaried versus hourly employees.

- The right accounting software can facilitate the process of tracking and compensating overtime as well as other business expenses.

- To calculate their overtime pay, it is necessary to establish their regular hourly rate by dividing their weekly salary by the expected number of hours in a week.

- The contents of this document do not have the force and effect of law and are not meant to bind the public in any way.

In some professions, working overtime is very common (or even mandatory!). Examples of personnel often working overtime might be construction workers, IT professionals, plant managers, and investment-related workers. From this information, our calculator will give you the details you need to know regarding your overtime. We believe that time is the most valuable thing we have and it’s in our hands to make it count.

So, asking them to work a few extra hours won’t have as large an impact on your labor budget as asking a full-time employee to work to cover the shift. Divide the weekly salary by the number of hours you expect the employee to work. Unless you have a policy that states employees aren’t allowed to work certain hours, all hours worked in excess of 40 hours per week must be paid time and a half. This guide is intended to be used as a starting point in analyzing overtime pay and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. All remuneration for employment (including shift differentials and bonuses) except those payments specifically excluded by statute.

For today’s hybrid teams that consist of a combination of on-site, remote, and mobile employees, a powerful time… The Inch software won’t crunch the numbers for you — you have to learn how to calculate overtime for yourself. Chances are, those part-time team members are nowhere near accumulating enough hours to push them beyond the 40-hours-per-week mark. Such accessibility can help cut down on instances when employees don’t show up for work and can help prevent the need to bring in a substitute who might have to work overtime. A powerful way to reduce the impact that overtime has on your budget is to monitor labor costs in real time. In most cases, that means keeping an eye on your labor budget as you schedule.

By law, some salaried employees are exempt from receiving overtime, but others are not. In general, bonuses and commissions are not included in regular rate calculations for overtime pay. However, certain types of nondiscretionary bonuses may need to be factored in, depending on local labor laws and regulations. Find out how much the employee earns per hour for their normal working hours (regular hourly wage). Also, check the number of hours they need to work in a week to qualify for overtime pay (overtime threshold). In the US, overtime pay usually starts after working more than 40 hours in a week.

With the right tools, managing a flexible workforce doesn’t have to be overwhelming or complicated. Since remote work and flexible schedules are more prevalent now than ever, you’ll need a scheduling solution that allows for a certain amount of flexibility. If there’s not enough work to justify overtime on any given week, use the scheduling software to limit the number of hours an employee can work that week. That way, they How to calculate overtime pay can work within their own parameters day to day, but they will not be able to exceed 40 hours in the week. It’s worth noting that employers are not obligated to provide extra compensation for the weekend or nighttime hours unless the total hours worked in a week surpass 40. In some states, such as California, the employee making $45,000 is still eligible for overtime, even though the FLSA doesn’t require them to be.

Some states have regulations for overtime and other labor laws that exceed those of the federal government. Check with your state’s labor department to review state labor laws, or check with your employment attorney. If an employee works more than a specified number of hours in a week, the additional hours are called overtime. Pay for any hours worked as overtime are paid at a higher rate than regular hours.